From 1 September 2025, the ACT Government is changing how stamp duty is charged on motor vehicle registrations. Most vehicles, including zero-emission vehicles (ZEVs), plug-in hybrids (PHEVs), and hybrids will no longer be exempt from paying stamp duty. All vehicles will now attract a minimum stamp duty rate of 2.5%. For vehicles worth over $80,000, an extra 8% duty will apply to the value above that threshold. This means that even environmentally friendly or previously exempt vehicles will now have to pay some level of duty when first registered.

Stamp duty will still be based on the vehicle’s value and environmental performance (its "emissions category"). Rates vary depending on the price bracket and the emissions rating. The more expensive or less environmentally friendly a vehicle is, the more stamp duty you'll pay. For a simple breakdown of the updated categories, rates, and examples, please refer to the table below.

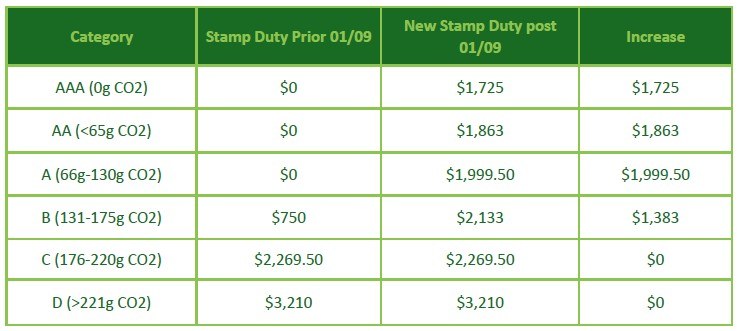

The main changes based on our average sale cost of $60,000 are below:

For more information visit - Motor vehicle duty | ACT Revenue Office - Website

Duty amounts payable – from 1 September 2025